What’s an FHA loan?

You know that feeling when you're way over your head on a subject you feel you're expected to know? That's how a lot of people feel about mortgages. We get it. This blog is here to serve as a comprehensive breakdown of what an FHA loan is. Written in plain english, simple to understand so you can be more informed about your future choices.

The beginning …

First, what does FHA even mean? The name comes from the "Federal Housing Administration" who are the originators of this loan. It was introduced during the Great Depression due to the sheer amount of defaults and foreclosures that were happening. Because these loans were insured by the government, it reduced the risk to lenders which, in turn, gave the housing market a lot more life, especially for low-income individuals. Fast forward to the present day, and these loans still hold true.

What's in an FHA loan?

What are the specifics of a home loan? Let's address these below:

Down payment can be as low as 3.5%* – This loan product does away with the notion that you need to put 20% of your home's value down as your initial payment. Let's break it down with a home that costs $200,000.

- 20% down payment = $40,000 due at closing (not including closing costs)

- 5% down payment = $7,000 due at closing (not including closing costs)

That price discrepancy can make a world of difference when purchasing a home. But, there are still some required costs to consider.

Mortgage insurance is required. It ensures the lender in the case of a borrower defaulting on a loan. There are two types of mortgage insurance premiums:

1. Upfront Mortgage Insurance Premium – this is where you pay 1.75% of your home's cost as your mortgage insurance "upfront" or during closing. Let's take the $200,000 price tag from the earlier example.

- 75% of home value = $3,500

- 5% down payment – $7,000

- That total would be $10,500. Once that is paid, your monthly mortgage payment breakdown would look the same as if you'd put 20% down.

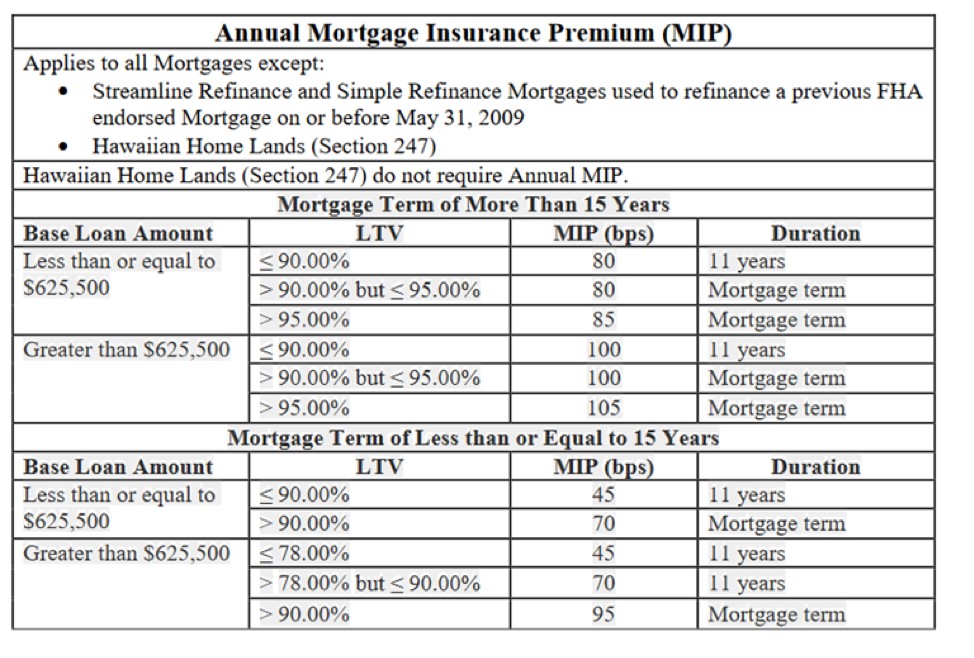

2. Annual Mortgage Insurance Premium – this is a percentage of your loan amount and is calculated on a yearly basis then paid in monthly installments. The actual amount depends on the annual length of the loan and the loan-to-value (LTV – video explanation of that here) ratio. Your LTV will terminate after a set period of time. Check the chart below on how it breaks down.

Minimum credit score (for Movement Mortgage) is 620 – However, if you meet other compensating factors defined in our credit policies, the required credit score can go as low as 580. Don't have a credit score? Sometimes that can be circumvented. We'd look at things like payment history on various bills and rental history.

Steady history of employment is required – You'll need to be employed for a minimum of two years in order to qualify. This is largely due to DTI ratio requirements.

Other things you'll need are:

- Be two years out of bankruptcy

- Lender must be approved by the FHA board.

- Legal age, SSN, and lawful US resident

Another thing to note, the seller, homebuilder or lender is allowed to pay some of the closing costs. That's something to remember as you head to the negotiating table.

Is the FHA loan product for you? It's a solid product, but not for everybody. If your credit score is lower than 580, you probably won't qualify. If you can afford a larger down payment, a conventional mortgage may save you more money in the long run. Find a Movement Mortgage loan officer for help deciding if this type of loan is right for you.

Happy house hunting!

* for qualified borrowers